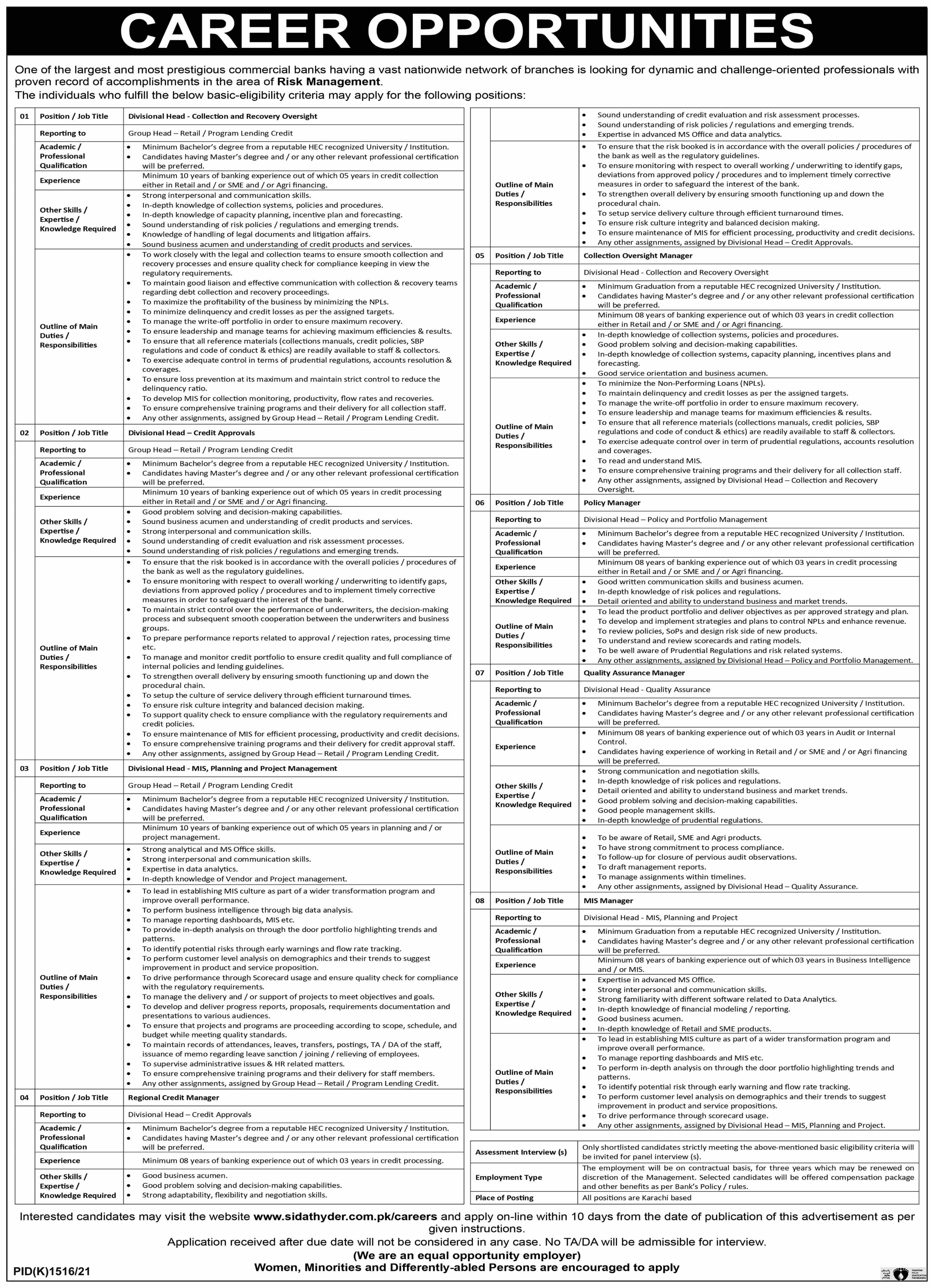

| 01 |

Position / Job Title |

Divisional Head - Collection and Recovery Oversight |

| |

Reporting to Academic / Professional Qualification Experience Other Skills / Expertise / Knowledge Required Outline of Main Duties / Responsibilities |

Group Head — Retail / Program Lending Credit

- Minimum Bachelor's degree from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

- Minimum 10 years of banking experience out of which 05 years in credit collection either in Retail and / or SME and / or Agri financing.

- Strong interpersonal and communication skills.

- In-depth knowledge of collection systems, policies and procedures.

- In-depth knowledge of capacity planning, incentive plan and forecasting.

- Sound understanding of risk policies / regulations and emerging trends.

- Knowledge of handling of legal documents and litigation affairs.

- Sound business acumen and understanding of credit products and services.

- To work closely with the legal and collection teams to ensure smooth collection and recovery processes and ensure quality check for compliance keeping in view the regulatory requirements.

- To maintain good liaison and effective communication with collection & recovery teams regarding debt collection and recovery proceedings.

- To maximize the profitability of the business by minimizing the NPLs.

- To minimize delinquency and credit losses as per the assigned targets.

- To manage the write-off portfolio in order to ensure maximum recovery.

- To ensure leadership and manage teams for achieving maximum efficiencies & results.

- To ensure that all reference materials (collections manuals, credit policies, SBP regulations and code of conduct & ethics) are readily available to staff & collectors.

- To exercise adequate control in terms of prudential regulations, accounts resolution & coverages.

- To ensure loss prevention at its maximum and maintain strict control to reduce the delinquency ratio.

- To develop MIS for collection monitoring, productivity, flow rates and recoveries.

- To ensure comprehensive training programs and their delivery for all collection staff.

- Any other assignments, assigned by Group Head — Retail / Program Lending Credit.

|

| 02 |

Position / Job Title |

Divisional Head — Credit Approvals |

| |

Reporting to Academic / Professional Qualification Experience Other Skills / Expertise / Knowledge Required Outline of Main Duties / Responsibilities |

Group Head — Retail / Program Lending Credit

- Minimum Bachelor's degree from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

- Minimum 10 years of banking experience out of which 05 years in credit processing either in Retail and / or SME and / or Agri financing.

- Good problem solving and decision-making capabilities.

- Sound business acumen and understanding of credit products and services.

- Strong interpersonal and communication skills.

- Sound understanding of credit evaluation and risk assessment processes.

- Sound understanding of risk policies / regulations and emerging trends.

- To ensure that the risk booked is in accordance with the overall policies / procedures of the bank as well as the regulatory guidelines.

- To ensure monitoring with respect to overall working / underwriting to identify gaps, deviations from approved policy / procedures and to implement timely corrective measures in order to safeguard the interest of the bank.

- To maintain strict control over the performance of underwriters, the decision-making process and subsequent smooth cooperation between the underwriters and business groups.

- To prepare performance reports related to approval / rejection rates, processing time etc.

- To manage and monitor credit portfolio to ensure credit quality and full compliance of internal policies and lending guidelines.

- To strengthen overall delivery by ensuring smooth functioning up and down the procedural chain.

- To setup the culture of service delivery through efficient turnaround times.

- To ensure risk culture integrity and balanced decision making.

- To support quality check to ensure compliance with the regulatory requirements and credit policies.

- To ensure maintenance of MIS for efficient processing, productivity and credit decisions.

- To ensure comprehensive training programs and their delivery for credit approval staff.

- Any other assignments, assigned by Group Head — Retail / Program Lending Credit.

|

| 03 |

Position / Job Title |

Divisional Head - MIS, Planning and Project Management |

| |

Reporting to Academic / Professional Qualification Experience Other Skills / Expertise / Knowledge Required Outline of Main Duties / Responsibilities |

Group Head — Retail / Program Lending Credit

- Minimum Bachelor's degree from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

- Minimum 10 years of banking experience out of which 05 years in planning and / or project management.

- Strong analytical and MS Office skills.

- Strong interpersonal and communication skills.

- Expertise in data analytics.

- In-depth knowledge of Vendor and Project management.

- To lead in establishing MIS culture as part of a wider transformation program and improve overall performance.

- To perform business intelligence through big data analysis.

- To manage reporting dashboards, MIS etc.

- To provide in-depth analysis on through the door portfolio highlighting trends and patterns.

- To identify potential risks through early warnings and flow rate tracking.

- To perform customer level analysis on demographics and their trends to suggest improvement in product and service proposition.

- To drive performance through Scorecard usage and ensure quality check for compliance with the regulatory requirements.

- To manage the delivery and / or support of projects to meet objectives and goals.

- To develop and deliver progress reports, proposals, requirements documentation and presentations to various audiences.

- To ensure that projects and programs are proceeding according to scope, schedule, and budget while meeting quality standards.

- To maintain records of attendances, leaves, transfers, postings, TA / DA of the staff, issuance of memo regarding leave sanction / joining / relieving of employees.

- To supervise administrative issues & HR related matters.

- To ensure comprehensive training programs and their delivery for staff members.

- Any other assignments, assigned by Group Head — Retail / Program Lending Credit.

|

| 04 |

Position / Job Title |

Regional Credit Manager |

| |

Reporting to Academic / Professional Qualification Experience Other Skills / Expertise / Knowledge Required Outline of Main Duties / Responsibilities |

Divisional Head — Credit Approvals

- Minimum Bachelor's degree from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

- Minimum 08 years of banking experience out of which 03 years in credit processing.

- Good business acumen.

- Good problem solving and decision-making capabilities.

- Strong adaptability, flexibility and negotiation skills.

- Sound understanding of credit evaluation and risk assessment processes.

- Sound understanding of risk policies / regulations and emerging trends.

- Expertise in advanced MS Office and data analytics.

- To ensure that the risk booked is in accordance with the overall policies / procedures of the bank as well as the regulatory guidelines.

- To ensure monitoring with respect to overall working / underwriting to identify gaps, deviations from approved policy / procedures and to implement timely corrective measures in order to safeguard the interest of the bank.

- To strengthen overall delivery by ensuring smooth functioning up and down the procedural chain.

- To setup service delivery culture through efficient turnaround times.

- To ensure risk culture integrity and balanced decision making.

- To ensure maintenance of MIS for efficient processing, productivity and credit decisions.

- Any other assignments, assigned by Divisional Head — Credit Approvals.

|

| 05 |

Position / Job Title |

Collection Oversight Manager |

| |

Reporting to Academic / Professional Qualification Experience Other Skills / Expertise / Knowledge Required Outline of Main Duties / Responsibilities |

Divisional Head - Collection and Recovery Oversight

- Minimum Graduation from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

- Minimum 08 years of banking experience out of which 03 years in credit collection either in Retail and / or SME and / or Agri financing.

- In-depth knowledge of collection systems, policies and procedures.

- Good problem solving and decision-making capabilities.

- In-depth knowledge of collection systems, capacity planning, incentives plans and forecasting.

- Good service orientation and business acumen.

- To minimize the Non-Performing Loans (NPLs).

- To maintain delinquency and credit losses as per the assigned targets.

- To manage the write-off portfolio in order to ensure maximum recovery.

- To ensure leadership and manage teams for maximum efficiencies & results.

- To ensure that all reference materials (collections manuals, credit policies, SBP regulations and code of conduct & ethics) are readily available to staff & collectors.

- To exercise adequate control over in term of prudential regulations, accounts resolution and coverages.

- To read and understand MIS.

- To ensure comprehensive training programs and their delivery for all collection staff.

- Any other assignments, assigned by Divisional Head — Collection and Recovery Oversight.

|

| 06 |

Position / Job Title |

Policy Manager |

| |

Reporting to Academic / Professional Qualification Experience Other Skills / Expertise / Knowledge Required Outline of Main Duties / Responsibilities |

Divisional Head — Policy and Portfolio Management

- Minimum Bachelor's degree from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

- Minimum 08 years of banking experience out of which 03 years in credit processing either in Retail and / or SME and / or Agri financing.

- Good written communication skills and business acumen.

- In-depth knowledge of risk polices and regulations.

- Detail oriented and ability to understand business and market trends.

- To lead the product portfolio and deliver objectives as per approved strategy and plan.

- To develop and implement strategies and plans to control NPLs and enhance revenue.

- To review policies, SoPs and design risk side of new products.

- To understand and review scorecards and rating models.

- To be well aware of Prudential Regulations and risk related systems.

- Any other assignments, assigned by Divisional Head — Policy and Portfolio Management.

|

| 07 |

Position / Job Title |

Quality Assurance Manager |

| |

Reporting to Academic / Professional Qualification Experience Other Skills / Expertise / Knowledge Required Outline of Main Duties / Responsibilities |

Divisional Head - Quality Assurance

- Minimum Bachelor's degree from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

- Minimum 08 years of banking experience out of which 03 years in Audit or Internal Control.

- Candidates having experience of working in Retail and / or SME and / or Agri financing will be preferred.

- Strong communication and negotiation skills.

- In-depth knowledge of risk polices and regulations.

- Detail oriented and ability to understand business and market trends.

- Good problem solving and decision-making capabilities.

- Good people management skills.

- In-depth knowledge of prudential regulations.

- To be aware of Retail, SME and Agri products.

- To have strong commitment to process compliance.

- To follow-up for closure of pervious audit observations.

- To draft management reports.

- To manage assignments within timelines.

- Any other assignments, assigned by Divisional Head — Quality Assurance.

|

| 08 |

Position / Job Title |

MIS Manager |

| |

Reporting to Academic / Professional Qualification Experience Other Skills / Expertise / Knowledge Required Outline of Main Duties / Responsibilities |

Divisional Head - MIS, Planning and Project

- Minimum Graduation from a reputable HEC recognized University / Institution.

- Candidates having Master's degree and / or any other relevant professional certification will be preferred.

- Minimum 08 years of banking experience out of which 03 years in Business Intelligence and / or MIS.

- Expertise in advanced MS Office.

- Strong interpersonal and communication skills.

- Strong familiarity with different software related to Data Analytics.

- In-depth knowledge of financial modeling / reporting.

- Good business acumen.

- In-depth knowledge of Retail and SME products.

- To lead in establishing MIS culture as part of a wider transformation program and improve overall performance.

- To manage reporting dashboards and MIS etc.

- To perform in-depth analysis on through the door portfolio highlighting trends and patterns.

- To identify potential risk through early warning and flow rate tracking.

- To perform customer level analysis on demographics and their trends to suggest improvement in product and service propositions.

- To drive performance through scorecard usage.

- Any other assignments, assigned by Divisional Head — MIS, Planning and Project.

|

| Assessment Interview (s) |

Only shortlisted candidates strictly meeting the above-mentioned basic eligibility criteria will be invited for panel interview (s). |

| Employment Type |

The employment will be on contractual basis, for three years which may be renewed on discretion of the Management. Selected candidates will be offered compensation package and other benefits as per Bank's Policy / rules. |

| Place of Posting |

All positions are Karachi based |

.gif)