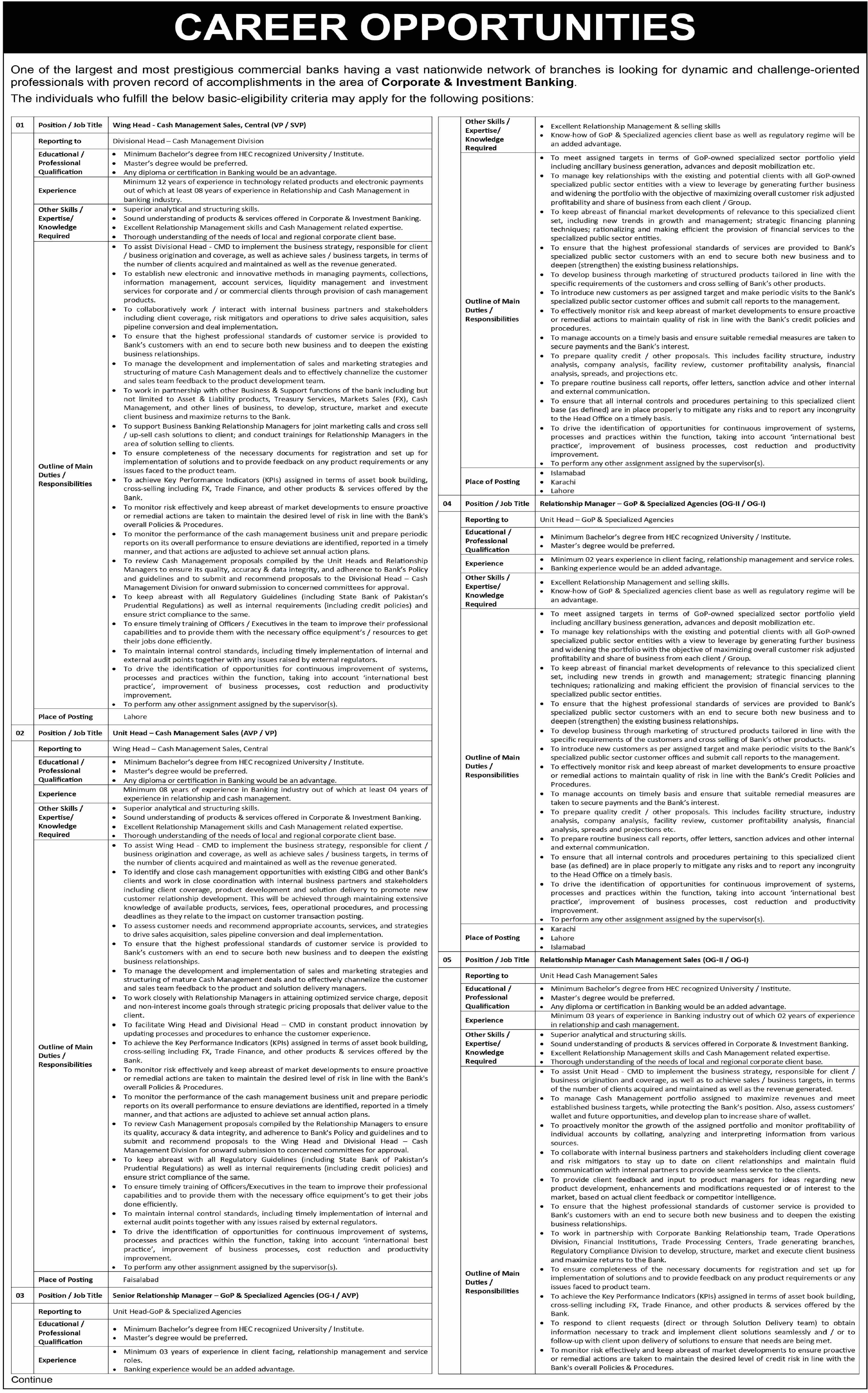

| 01 |

Position / Job Title |

Wing Head - Cash Management Sales, Central (VP / SVP) |

| |

Reporting to |

Divisional Head — Cash Management Division |

| Educational / Professional Qualification |

- Minimum Bachelor's degree from HEC recognized University / Institute.

- Master's degree would be preferred.

- Any diploma or certification in Banking would be an advantage.

|

| Experience |

Minimum 12 years of experience in technology related products and electronic payments out of which at least 08 years of experience in Relationship and Cash Management in banking industry. |

| Other Skills / Expertise/ Knowledge Required |

- Superior analytical and structuring skills.

- Sound understanding of products & services offered in Corporate & Investment Banking.

- Excellent Relationship Management skills and Cash Management related expertise.

- Thorough understanding of the needs of local and regional corporate client base.

|

| Outline of Main Duties / Responsibilities |

- To assist Divisional Head - CMD to implement the business strategy, responsible for client / business origination and coverage, as well as achieve sales / business targets, in terms of the number of clients acquired and maintained as well as the revenue generated.

- To establish new electronic and innovative methods in managing payments, collections, information management, account services, liquidity management and investment services for corporate and / or commercial clients through provision of cash management products.

- To collaboratively work / interact with internal business partners and stakeholders including client coverage, risk mitigators and operations to drive sales acquisition, sales pipeline conversion and deal implementation.

- To ensure that the highest professional standards of customer service is provided to Bank's customers with an end to secure both new business and to deepen the existing business relationships.

- To manage the development and implementation of sales and marketing strategies and structuring of mature Cash Management deals and to effectively channelize the customer and sales team feedback to the product development team.

- To work in partnership with other Business & Support functions of the bank including but not limited to Asset & Liability products, Treasury Services, Markets Sales (EX), Cash Management, and other lines of business, to develop, structure, market and execute client business and maximize returns to the Bank.

- To support Business Banking Relationship Managers for joint marketing calls and cross sell / up-sell cash solutions to client; and conduct trainings for Relationship Managers in the area of solution selling to clients.

- To ensure completeness of the necessary documents for registration and set up for implementation of solutions and to provide feedback on any product requirements or any issues faced to the product team.

- To achieve Key Performance Indicators (KPIs) assigned in terms of asset book building, cross-selling including FX, Trade Finance, and other products & services offered by the Bank.

- To monitor risk effectively and keep abreast of market developments to ensure proactive or remedial actions are taken to maintain the desired level of risk in line with the Bank's overall Policies & Procedures.

- To monitor the performance of the cash management business unit and prepare periodic reports on its overall performance to ensure deviations are identified, reported in a timely manner, and that actions are adjusted to achieve set annual action plans.

- To review Cash Management proposals compiled by the Unit Heads and Relationship Managers to ensure its quality, accuracy & data integrity, and adherence to Bank's Policy and guidelines and to submit and recommend proposals to the Divisional Head — Cash Management Division for onward submission to concerned committees for approval.

- To keep abreast with all Regulatory Guidelines (including State Bank of Pakistan's Prudential Regulations) as well as internal requirements (including credit policies) and ensure strict compliance to the same.

- To ensure timely training of Officers / Executives in the team to improve their professional capabilities and to provide them with the necessary office equipment's / resources to get their jobs done efficiently.

- To maintain internal control standards, including timely implementation of internal and external audit points together with any issues raised by external regulators.

- To drive the identification of opportunities for continuous improvement of systems, processes and practices within the function, taking into account 'international best practice', improvement of business processes, cost reduction and productivity improvement.

- To perform any other assignment assigned by the supervisor(s).

|

| Place of Posting |

Lahore |

| 02 |

Position / Job Title |

Unit Head — Cash Management Sales (AVP / VP) |

| |

Reporting to |

Wing Head — Cash Management Sales, Central |

| Educational / Professional Qualification |

- Minimum Bachelor's degree from HEC recognized University / Institute.

- Master's degree would be preferred.

- Any diploma or certification in Banking would be an advantage.

|

| Experience |

Minimum 08 years of experience in Banking industry out of which at least 04 years of experience in relationship and cash management. |

| Other Skills / Expertise/ Knowledge Required |

- Superior analytical and structuring skills.

- Sound understanding of products & services offered in Corporate & Investment Banking.

- Excellent Relationship Management skills and Cash Management related expertise.

- Thorough understanding of the needs of local and regional corporate client base.

|

| Outline of Main Duties / Responsibilities |

- To assist Wing Head - CMD to implement the business strategy, responsible for client / business origination and coverage, as well as achieve sales / business targets, in terms of the number of clients acquired and maintained as well as the revenue generated.

- To identify and close cash management opportunities with existing CIBG and other Bank's clients and work in close coordination with internal business partners and stakeholders including client coverage, product development and solution delivery to promote new customer relationship development. This will be achieved through maintaining extensive knowledge of available products, services, fees, operational procedures, and processing deadlines as they relate to the impact on customer transaction posting.

- To assess customer needs and recommend appropriate accounts, services, and strategies to drive sales acquisition, sales pipeline conversion and deal implementation.

- To ensure that the highest professional standards of customer service is provided to Bank's customers with an end to secure both new business and to deepen the existing business relationships.

- To manage the development and implementation of sales and marketing strategies and structuring of mature Cash Management deals and to effectively channelize the customer and sales team feedback to the product and solution delivery managers.

- To work closely with Relationship Managers in attaining optimized service charge, deposit and non-interest income goals through strategic pricing proposals that deliver value to the client.

- To facilitate Wing Head and Divisional Head — CMD in constant product innovation by updating processes and procedures to enhance the customer experience.

- To achieve the Key Performance Indicators (KPIs) assigned in terms of asset book building, cross-selling including FX, Trade Finance, and other products & services offered by the Bank.

- To monitor risk effectively and keep abreast of market developments to ensure proactive or remedial actions are taken to maintain the desired level of risk in line with the Bank's overall Policies & Procedures.

- To monitor the performance of the cash management business unit and prepare periodic reports on its overall performance to ensure deviations are identified, reported in a timely manner, and that actions are adjusted to achieve set annual action plans.

- To review Cash Management proposals compiled by the Relationship Managers to ensure its quality, accuracy & data integrity, and adherence to Bank's Policy and guidelines and to submit and recommend proposals to the Wing Head and Divisional Head — Cash Management Division for onward submission to concerned committees for approval.

- To keep abreast with all Regulatory Guidelines (including State Bank of Pakistan's Prudential Regulations) as well as internal requirements (including credit policies) and ensure strict compliance of the same.

- To ensure timely training of Officers/Executives in the team to improve their professional capabilities and to provide them with the necessary office equipment's to get their jobs done efficiently.

- To maintain internal control standards, including timely implementation of internal and external audit points together with any issues raised by external regulators.

- To drive the identification of opportunities for continuous improvement of systems, processes and practices within the function, taking into account 'international best practice', improvement of business processes, cost reduction and productivity improvement.

- To perform any other assignment assigned by the supervisor(s).

|

| Place of Posting |

Faisalabad |

| 03 |

Position / Job Title |

Senior Relationship Manager — GoP & Specialized Agencies (0G-1/ AVP) |

| |

Reporting to |

Unit Head-GoP & Specialized Agencies |

| Educational / Professional Qualification |

- Minimum Bachelor's degree from HEC recognized University / Institute.

- Master's degree would be preferred.

|

| Experience |

- Minimum 03 years of experience in client facing, relationship management and service roles.

- Banking experience would be an added advantage.

|

| |

Other Skills / Expertise/ Knowledge Required |

- Excellent Relationship Management & selling skills

- Know-how of GoP & Specialized agencies client base as well as regulatory regime will be an added advantage.

|

| Outline of Main Duties / Responsibilities |

- To meet assigned targets in terms of GoP-owned specialized sector portfolio yield including ancillary business generation, advances and deposit mobilization etc.

- To manage key relationships with the existing and potential clients with all GoP-owned specialized public sector entities with a view to leverage by generating further business and widening the portfolio with the objective of maximizing overall customer risk adjusted profitability and share of business from each client / Group.

- To keep abreast of financial market developments of relevance to this specialized client set, including new trends in growth and management; strategic financing planning techniques; rationalizing and making efficient the provision of financial services to the specialized public sector entities.

- To ensure that the highest professional standards of services are provided to Bank's specialized public sector customers with an end to secure both new business and to deepen (strengthen) the existing business relationships.

- To develop business through marketing of structured products tailored in line with the specific requirements of the customers and cross selling of Bank's other products.

- To introduce new customers as per assigned target and make periodic visits to the Bank's specialized public sector customer offices and submit call reports to the management.

- To effectively monitor risk and keep abreast of market developments to ensure proactive or remedial actions to maintain quality of risk in line with the Bank's credit policies and procedures.

- To manage accounts on a timely basis and ensure suitable remedial measures are taken to secure payments and the Bank's interest.

- To prepare quality credit / other proposals. This includes facility structure, industry analysis, company analysis, facility review, customer profitability analysis, financial analysis, spreads, and projections etc.

- To prepare routine business call reports, offer letters, sanction advice and other internal and external communication.

- To ensure that all internal controls and procedures pertaining to this specialized client base (as defined) are in place properly to mitigate any risks and to report any incongruity to the Head Office on a timely basis.

- To drive the identification of opportunities for continuous improvement of systems, processes and practices within the function, taking into account 'international best practice', improvement of business processes, cost reduction and productivity improvement.

- To perform any other assignment assigned by the supervisor(s).

|

| Place of Posting |

|

| 04 |

Position / Job Title |

Relationship Manager — GoP & Specialized Agencies (0G-11/ OG-1) |

| |

Reporting to |

Unit Head — GoP & Specialized Agencies |

| Educational / Professional Qualification |

- Minimum Bachelor's degree from HEC recognized University / Institute.

- Master's degree would be preferred.

|

| Experience |

- Minimum 02 years experience in client facing, relationship management and service roles.

- Banking experience would be an added advantage.

|

| Other Skills / Expertise/ Knowledge Required |

- Excellent Relationship Management and selling skills.

- Know-how of GoP & Specialized agencies client base as well as regulatory regime will be an advantage.

|

| Outline of Main Duties / Responsibilities |

- To meet assigned targets in terms of GoP-owned specialized sector portfolio yield including ancillary business generation, advances and deposit mobilization etc.

- To manage key relationships with the existing and potential clients with all GoP-owned specialized public sector entities with a view to leverage by generating further business and widening the portfolio with the objective of maximizing overall customer risk adjusted profitability and share of business from each client / Group.

- To keep abreast of financial market developments of relevance to this specialized client set, including new trends in growth and management; strategic financing planning techniques; rationalizing and making efficient the provision of financial services to the specialized public sector entities.

- To ensure that the highest professional standards of services are provided to Bank's specialized public sector customers with an end to secure both new business and to deepen (strengthen) the existing business relationships.

- To develop business through marketing of structured products tailored in line with the specific requirements of the customers and cross selling of Bank's other products.

- To introduce new customers as per assigned target and make periodic visits to the Bank's specialized public sector customer offices and submit call reports to the management.

- To effectively monitor risk and keep abreast of market developments to ensure proactive or remedial actions to maintain quality of risk in line with the Bank's Credit Policies and Procedures.

- To manage accounts on timely basis and ensure that suitable remedial measures are taken to secure payments and the Bank's interest.

- To prepare quality credit / other proposals. This includes facility structure, industry analysis, company analysis, facility review, customer profitability analysis, financial analysis, spreads and projections etc.

- To prepare routine business call reports, offer letters, sanction advices and other internal and external communication.

- To ensure that all internal controls and procedures pertaining to this specialized client base (as defined) are in place properly to mitigate any risks and to report any incongruity to the Head Office on a timely basis.

- To drive the identification of opportunities for continuous improvement of systems, processes and practices within the function, taking into account 'international best practice', improvement of business processes, cost reduction and productivity improvement.

- To perform any other assignment assigned by the supervisor(s).

|

| Place of Posting |

|

| 05 |

Position / Job Title |

Relationship Manager Cash Management Sales (0G-11/ OG-1) |

| |

Reporting to |

Unit Head Cash Management Sales |

| Educational / Professional Qualification |

- Minimum Bachelor's degree from HEC recognized University / Institute.

- Master's degree would be preferred.

- Any diploma or certification in Banking would be an added advantage.

|

| Experience |

Minimum 03 years of experience in Banking industry out of which 02 years of experience in relationship and cash management. |

| Other Skills / Expertise/ Knowledge Required |

- Superior analytical and structuring skills.

- Sound understanding of products & services offered in Corporate & Investment Banking.

- Excellent Relationship Management skills and Cash Management related expertise.

- Thorough understanding of the needs of local and regional corporate client base.

|

| Outline of Main Duties / Responsibilities |

- To assist Unit Head - CMD to implement the business strategy, responsible for client / business origination and coverage, as well as to achieve sales / business targets, in terms of the number of clients acquired and maintained as well as the revenue generated.

- To manage Cash Management portfolio assigned to maximize revenues and meet established business targets, while protecting the Bank's position. Also, assess customers' wallet and future opportunities, and develop plan to increase share of wallet.

- To proactively monitor the growth of the assigned portfolio and monitor profitability of individual accounts by collating, analyzing and interpreting information from various sources.

- To collaborate with internal business partners and stakeholders including client coverage and risk mitigators to stay up to date on client relationships and maintain fluid communication with internal partners to provide seamless service to the clients.

- To provide client feedback and input to product managers for ideas regarding new product development, enhancements and modifications requested or of interest to the market, based on actual client feedback or competitor intelligence.

- To ensure that the highest professional standards of customer service is provided to Bank's customers with an end to secure both new business and to deepen the existing business relationships.

- To work in partnership with Corporate Banking Relationship team, Trade Operations Division, Financial Institutions, Trade Processing Centers, Trade generating branches, Regulatory Compliance Division to develop, structure, market and execute client business and maximize returns to the Bank.

- To ensure completeness of the necessary documents for registration and set up for implementation of solutions and to provide feedback on any product requirements or any issues faced to product team.

- To achieve the Key Performance Indicators (KPIs) assigned in terms of asset book building, cross-selling including FX, Trade Finance, and other products & services offered by the Bank.

- To respond to client requests (direct or through Solution Delivery team) to obtain information necessary to track and implement client solutions seamlessly and / or to follow-up with client upon delivery of solutions to ensure that needs are being met.

- To monitor risk effectively and keep abreast of market developments to ensure proactive or remedial actions are taken to maintain the desired level of credit risk in line with the Bank's overall Policies & Procedures.

- To prepare Cash Management proposals ensuring quality, accuracy & data integrity, and adherence to Bank's Policy and guidelines and to submit and recommend business proposals to Divisional Head - Cash Management Division for onward submission to concerned committees for approval.

- To keep abreast with all Regulatory Guidelines (including State Bank of Pakistan's Prudential Regulations) as well as internal requirements (including credit policies) and ensure strict compliance.

- To maintain internal control standards, including timely implementation of internal and external audit points together with any issues raised by external regulators.

- To drive the identification of opportunities for continuous improvement of systems, processes and practices within the function, taking into account 'international best practice', improvement of business processes, cost reduction and productivity improvement.

- To perform any other assignment assigned by the supervisor(s)

|

| |

Place of Posting |

- Islamabad

- Lahore

- Faisalabad

- Multan

|

| 06 |

Position / Job Title |

Data Analyst (06-11 / 0G-l) |

| |

Reporting to |

Head - Strategy & Analytics Wing |

| Educational / Professional Qualification |

- Minimum Bachelor's degree from HEC recognized University / Institute.

- Master's degree would be preferred.

- Professional certifications related to banking or controls would be an added advantage.

|

| Experience |

- Minimum 02 years of relevant experience.

- Know-how of technology based tools would be preferred.

|

| Other Skills / Expertise/ Knowledge Required |

- Superior data collection, financial and quantitative analysis skills.

- Basic understanding of products & services offered in Corporate & Investment Banking.

- Proficient in understanding accounting entries in General Ledgers.

- Understand how 'Control Methodologies' are developed.

- Knowledge of Advanced MS Excel, any visualization tool.

- Proficient in MS Office.

- Good report writing skills.

- Sound knowledge of audit frameworks applicable in Pakistan.

|

Outline of Main

Duties / Responsibilities |

- To review General Ledger entries, manage data and reporting as per defined frequency.

- To acquire data from primary or secondary sources and develop superior quality

Dashboards, Visual displays used for management review.

- To critically analyze & consolidate MIS required on monthly / need basis.

- To assist / prepare annual budget for CIBG for management review and dissemination to relevant business.

- To closely monitor expenses, business performance of regional corporate / product teams against assigned budget.

- To facilitate in preparing important & confidential reports, presentations to the Board and senior management.

- To prepare and monitor expenses on monthly basis in consultation with supervisor against the assigned segment.

- To highlight and escalate any misreporting of financial information received from the regional corporate centers / Divisions.

- To ensure no audit observations are recorded during internal or regulatory audits.

- To assist supervisor in developing control methodologies.

- To understand systemic rules applied on data to develop meaningful interfaces

- To interpret and analyze financial and non-financial information.

- To help in identifying how policy and procedures can be improved for optimization.

- To help in identifying any income leakage for Corporate Banking businesses.

- To perform any other assignment assigned by the supervisor(s).

|

| Place of Posting |

Karachi |

.jpg)